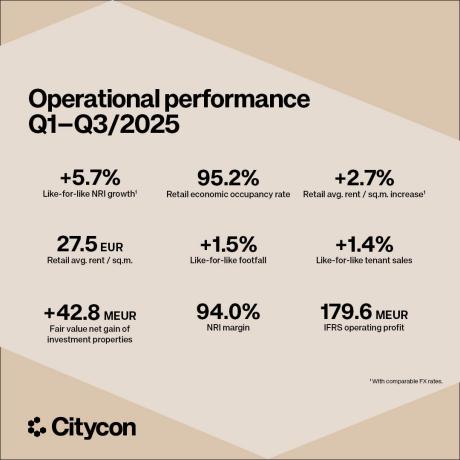

We delivered solid performance during the first nine months of 2025, like-for-like net rental income growth was 5.7% compared to same period last year in comparable FX. This growth was supported by higher retail economic occupancy rate and rental uplifts. Footfall and tenant sales also showed positive momentum, rising by 1.5% and 1.4% respectively during Q1-Q3/2025 compared to last year. Net rental income margin was solid at 94.0% in Q1-Q3/2025. Further, we had a significant, 22% reduction in administrative expenses in Q1-Q3/2025 compared to last year.

The positive trend accelerated in the third quarter of the year, where like-for-like net rental income grew by 6.8% compared to the same period previous year in comparable FX. The strong result was driven by improving retail economic occupancy rate which grew by 20 basis points quarter-on-quarter to 95.2% in Q3/2025, while footfall and tenant sales increased by 2.8% and 1.6% respectively in Q3/2025 compared to previous year.

These results demonstrate the continued attractiveness of our assets and the effectiveness of our operational strategy which was reflected in fair value gains of our portfolio. In Q3/2025 we recognized fair value gains of EUR 8.6 million and during the first nine months fair value gains reached EUR 42.8 million. We also continued our proactive debt management in Q3/2025 as we completed a hybrid bond tender for around EUR 35 million. All in all, we have prepaid debt for over EUR 750 million during Q1-Q3/2025.

Our year 2025 outlook is tightened to:

- EPRA Earnings per share EUR 0.41-0.46

- EPRA Earnings per share excluding hybrid bond interests EUR 0.60-0.65

I have the privilege of having spent my first months as the CEO of Citycon. I have started by getting to know our people and our assets and I am pleased to say that we have both great people and high-quality assets. One of our first steps has been to shift focus more to country level. We are also continuing to implement measures to improve efficiency with emphasis on revenue growth and gaining better control over costs. Based on this our operational assumptions for year 2026 are built around two main components:

- Like-for-like net rental income growth including specialty leasing above the consumer price index

- G&A optimisation and operational cost reduction

On the financing side our focus continues to be on further strengthening and de-risking our balance sheet. Post Q3/2025 in October 2025 Citycon successfully completed a refinancing and extension of the committed Revolving credit facility. The new sustainability-linked facility matures in October 2029 with a potential one-year extension to October 2030. Further, the facility was increased from EUR 200 million to EUR 250 million.

Eshel Pesti

Citycon's CEO

Source: Citycon's Q3/2025 Interim Report